**Tariffic Goods

A look into the role of the Toronto Customs House in the Victorian Era

Dyllan Gregoire

Toronto - 2023

The City of Toronto standing as the Provincial Capital of Ontario Canada is due to a variety of factors one of which has to deal with its location, formerly known as the town of “York” had a beneficial position with a safe connected harbor that connects to Lake Ontario, which through the St Lawrence River leads towards the Atlantic and connects Toronto to the rest of the Global World.1 With its great location and ability to connect with the greater world, the implementation of a “Customs House” was essential for the city of Toronto to benefit from its key location. The Role of the Customs House is to collect on “duties” for all goods coming into and out of the Canadian Market, acting as a form of taxation or tariff on the matter.2 During the Victorian Era these Custom Houses were essential for the growth of settlements like York whose population was still growing and its greatest source of revenue came from the tariffs paid on trade.3 The Customs Houses were not only a source of income, but it was also a government institution and an enforcer of censorship within the City of Toronto, which molded the once small harbor colony into one of the many metropolitan cities of our modern world.

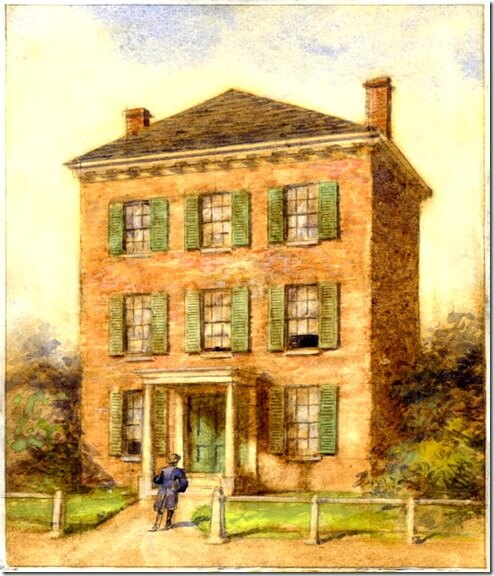

The Customs House Worked by housing goods coming into and out of the City by storing them within warehouses where all the goods are tallied up and their value is determined, before a tariff or otherwise known as a tax would be required to be paid on the import and exporting goods.4 This collection of taxes or duties on imports and exports was one way the City of Toronto; as well as other Cities with similar Customs Houses, would profit from the activity of merchants and trading while also aiding in the maintenance of such facilities which allow trade to flourish, such as the docks, warehouses and loading areas. The Customs House was one of the first structures built in Toronto, and even before the Customs House of 1870, three previous houses preceded it. The Customs House would be rebuilt and moved as Toronto grew and new structures were built as it was renovated and modernized. Figure 1 showcases the Customs House during the years of 1870 to 1876, having been the fourth structure in Toronto to be the Customs House.5

The Customs House along with the Harbour held an import relationship, as goods that were to be exported or brought into the city had to be stored at the Customs House for a time until the proper duties could be collected on the goods. In February of 1883 a report showed some of the goods stored at the Port of Toronto, and the profits earned for them.6 Figure 2, there is an example of Ale and Porter in casks and bottles that was being brought in for consumption, the quantity of which was 1,335 casks and bottles total, which was valued at a price of \$658 which according to some inflation calculators would be closer to \$25,000 dollars in today’s money, which the Customs House collected \$195.66 dollars of which is about 33 percent of the total value of those items.7 The Customs House generated profits on incoming goods meant for the consumption of the masses, as the Customs House could take a portion of the revenue that the merchants would earn to fund themselves. This was also true on exports as well, as in Figure 4 detailing the exports, Planks of Wood of which they had 207 of, were valued at \$3,033, which would be close to \$87,000 dollars in today’s money. As another final note, the total of all duties collected on all goods being brought into Toronto in February, was \$408,713,87 which is a significant amount of money made off the 1,771 goods that they collected duties for.8 This was also true on exports as well, as on another document detailing the exports, Planks of Wood of which they had 207 of, were valued at \$3,033, which would be close to \$87,000 dollars in today’s money. As another final note, the total of all duties collected on all goods being brought into Toronto in February, was \$408,713,87 which is a significant amount of money made off the 1,771 goods that they collected duties from.

The Numbers that can be seen on these documents gives a good insight into the market of Canada at the time. Imports on goods from abroad and from America did help supply the domestic economy with supplies like agricultural products from meats and animals, industrial products like coal, oil, metals and with luxury products like tobacco. Most of those products were for consumption, and also supplied Toronto with supplies that are otherwise difficult to develop. Products such as Machinery, Rails and Coal are of important note as well, as those products may be difficult to get domestically, so importing those goods into the Canadian economy was one way to get resources they otherwise may not have had, which helped Canada grow its own Industry. The Customs House also helped make these imports profitable as the money they got through duties could be reinvested into more imports or for projects at home, such as maintaining their infrastructure, investing in public projects, paying the staff and many other functions that are needed to run the city and maintain a stable and growing economy.

The Customs House also dealt with smuggling when it came to products coming into Canada, as the Customs House could search any vessel and check everything on board and storing it until all the details are finalized and the duties collected. The purpose of this was to police the goods that would come into the market, ensuring that all products are visible and can be taxed, as quoted “To tax a good frequently required it to be rendered visible both in terms of its ingredients and how it was produced.”9 In the Modern Day this happens at any border crossing too, and especially in airports as Customs have adapted to other ways of entering into a country. To ensure that duties are collected is to make sure that everything being brought in is declared and recorded by the merchants and businessmen coming into the market.

For a significant portion of time, Customs Houses were also required to report back to London as they fell under the London Board of Customs which continued as a practice until the repeal of the mercantile Navigations Act in 1849.10 The Navigations Act previously only permitted English Ships to trade with the Colonies, and that Colony goods could only be exported to England. What this meant is that the colonies could only trade with England and none of the other Europeans.11 This meant that once the Navigations Act was repealed in 1849, the Customs House reported directly to the treasury of their local colonial legislation and that the colony could trade with whoever they wished, which granted further autonomy to the colonies, and this remained true in many colonial holdings. Colonial Customs within the colonies in Canada and other British holdings such as New Zealand and South Australia could be regarded as an imperial institution with their own house rules and symbols to differentiate themselves.12 The practices of the Customs House were not as affected by the repeal of the Navigations Act, as they functioned mostly the same albeit with the cause that they reported to the Colony rather than the Board of Customs, and historically the repeal of the Navigations Act also prioritized the importation of food through cheap foreign imports so that it could mean that the cost of maintaining labor for the same sort of supplies can be reduced, especially during the Victorian Era where it was preferable for workers to be in factories rather than farmsteads.

The Victorian Era which saw a rise of industrialization and new resources used within the market such as machinery and food from abroad. Items such as buckwheat and meat were still being imported along with ale as it could be brought in fairly cheap, and the Customs House ensured that some profit was also gained on the taxation of those goods coming into Toronto and abroad. With the repeal of the Navigations Act, it also meant that Toronto was able to trade with other countries for the valuable resources of coal, steel, and all other items that Canada may have needed to industrialize, which promoted industrialization in Canada and allowed its economy to improve further than if it could only trade with England. Furthermore, with railways and trains becoming available, more goods could be transported over to ports like Toronto to then be shipped out to other countries which meant more exports and more income for Canadian people.

One issue of the Navigations Act is that Canada could only trade with England, it meant that the colonies were subject to the instruction of England itself on what could and couldn’t be taxed. One resource detailing the instructions towards the Queens Provincial Customs can give further insight into how this impacted the Customs Act again until the repeal of the Navigation Act just five years later. Instructions to officers of her majesty’s provincial customs, showcases important information about the exact duties which the Customs House must collect. Timber was taxed for 7 and ½ duties per cubic foot with 5 percent duties taxation and for a product such as Butter it is taxed at 5 shillings, and should every hundred weight of butter be damaged then one pint of tar is to be mixed within.13 It also should be noted that Corn Meal of the Indian Variety was prohibited which meant that the taxation of Corn Meal was not allowed for that particular product, and Salmon was Free so long as the Master of the Ship declares that the Salmon was caught on British Ships and Cured by Her Majesty’s subjects.14 For products such as Salmon and Butter, we can directly compare to the duties which were imposed for the 1883 Customs House of Toronto which Butter was taxed at \$1.00 duty for the 25 butter which was valued at \$5. Salmon on the other hand isn’t directly listed, however fish valued at about \$1,475 were taxed for \$294.15 While it is unclear if the Salmon was included within the list, the possibility of it being taxed by the Customs House now that is reported directly to the Colony of Toronto could mean a bit of taxation on products where there wasn’t before, an interesting concept to think about as the Colony had more say on what it wanted to tax and the price.

With further Colonial Autonomy for Customs Houses and the Colonies as a whole, new developments in economics and commerce could be instigated within the Colonies, such as the Toronto Board of Trade which sought further statues of incorporation from the Government of Provincial Canada. What this meant was that within the Victorian era and the 1840’s onwards. Towns and cities would follow suite and further promote customs, commerce and to render prosperous trade for the Province of Canada.16 Within the Victorian Era economic development for Canada would continue to grow and that merchants, traders, mechanics and further capitalists would take a primary focus within the Canadian Economy especially by 1876 the Chambers of Commerce was deemed to hold the same powers as Boards of Trade in general. What this meant for Customs Houses is that they become even further integrated into Urban Communities, and as Capitalism would grow and develop as the primary economic style of the Western World, so too would the Customs House modernize and take not new holdings. As the City of Toronto would grow, so too would the need to grow and expand the Customs House which brings about how it developed within the Victorian Era.

By the year 1875 as shown in Figure 5, the Customs House was moved towards Front Street with new Steel Bar construction for the site, which shows the more modern techniques being used for the structure as construction methods improve.17 The Customs House was also considered one of the most impressive buildings in 1876, Figure 6 illustrates the ornate cement, stone work and a classical façade, similar in kind to the structure of Banks, Public Buildings and Theaters of the Era.18 What this meant is that the Customs House grew in size and importance in the Urban Center of Toronto.

The impressive nature of the Structure in an Urbanized Toronto further showcases the prestige and the importance of such a building for Toronto, from the humble yet still impressive brick of Front Street East to the Customs House which was rebuilt within the same Front Street, and the Customs Examining Warehouse which is where products brought in were to be held and accounted for the collection of duties as mentioned before. This structure would remain and even survive the great fire of 1904, and it would not be until 1919 that it would be demolished for a new structure and customs house which remains along Front Street (figure 7).19

The Customs House as it was made in 1935 remains in the same location on Front Street to this day in 2023, surrounded by modern buildings such as the CN tower. The Customs House of the Victorian Era saw unprecedented growth and remains a fixture within the city of Toronto, and while we move towards the future the importance of the Customs House for the economic development of Canada cannot be understated as millions upon millions of duties were collected for the Canadian Government over the course of Centuries, which helped Canada develop into a modern Country of the Western World.

In conclusion, the Customs House, and its importance in collecting tariffs for Toronto has been a mainstay in the city since its inception. This has helped in supporting the Canadian economy with its collection of taxes on trade. Although the Customs House was rebuilt in a different location, it still stands as a reminder of an important government institution in Toronto and for Canada as a whole.

-

Doug Taylor, Toronto’s historic old Customs House. Tayloronhistory.com, March 6, 2016. Toronto’s historic old Customs Houses - Historic Toronto (tayloronhistory.com) https://tayloronhistory.com/2016/03/06/torontos-historic-old-customs-houses/ ↩

-

Taylor, Toronto’s historic old Customs House. ↩

-

Taylor, Toronto’s historic old Customs House. ↩

-

Isabel Hofmeyr, Dockside Reading: Hydrocolonialism and the Customs House. Duke University Press, 2022, 28. ↩

-

Figure 1: The Customs House of 1870, one of the first structures built in Toronto. Owen Staples, Custom House (1870-1876), Front St. West, north side, between Yonge Street and Bay Street. Painting (1912). Toronto Public Library, PICTURES-R-2272. ↩

-

Monthly returns of imports and exports at the Port of Toronto for February 1883*. Toronto: [s.n., 1883], ↩

-

Figure 2: Summary statement of the Duty that the Customs House in the Port of Toronto collected for the month ending February 28th, 1883. Monthly returns of imports and exports at the Port of Toronto for February 1883, ↩

-

Monthly returns of imports and exports at the Port of Toronto for February 1883*, 8. ↩

-

Hofmeyer, Hydrocolonialism and the Customs House, 28. ↩

-

Hofmeyer, Hydrocoloialism and the Customs House, 28. ↩

-

Khan Academy, “The Navigation Acts (Article),” n.d. https://www.khanacademy.org/humanities/us-history/colonial-america/colonial-north-america/a/the-navigation-acts ↩

-

Khan Academy, “The Navigation Acts.” ↩

-

J.K. Dunscomb, Instructions to Officers of Her Majesty’s Provincial Customs. (Montreal 1844), 98. https://www.canadiana.ca/view/oocihm.60282 ↩

-

Dunscomb, Instructions to Officers, 98. ↩

-

Dunscomb, Instructions to Officers, 98. ↩

-

Elizabeth Bloomsfield, Research Note, Boards of Trade and Canadian Urvan Development. V2, Urban History Review, October 1983. https://www.erudit.org/en/journals/uhr/1900-v1-n1-uhr0860/1018959ar.pdf . ↩

-

Figure 5: North façade on Front Street of the Customs House on May 5, 1875, when it was under construction. Notman and Fraser, Custom House [under construction], Toronto, Ont. Canada Archives, a 046269-v8. ↩

-

Figure 6: The Customs House in 1876, to the south of it, is the Custom’s Examining Warehouse. Unknown Author, Custom House (1876-1919), Front St. West, southwest corner of Yonge St., Photograph (1910). Toronto Public Library, PICTURES-R-3949 ↩

-

Figure 7: The Dominion Building in 1935, shortly after it was completed. View gazes west along Front Street from Younge. Taylor, Toronto’s historic old Customs House. Canada Archives, a068224-v8. ↩